How to Calculate Net Profit for Your WooCommerce Store

Let’s talk numbers—but not the kind that WooCommerce flashes in big, shiny letters on your dashboard. We’re going behind the curtain, past the glam of gross sales, and into the gritty, unsexy, but ultra-important realm of net profit.

Because here’s the truth: Revenue tells you how busy your store is. Net profit tells you how successful it is.

If you want to sustainably grow your WooCommerce store, track smart marketing decisions, and sleep at night knowing you’re not secretly losing money on every sale—then calculating net profit is absolutely non-negotiable.

So let’s dig into how to calculate net profit in WooCommerce, step by step, what to include (and what not to forget), and how tools like Alpha Insights make the process a lot less painful.

What Is Net Profit (And Why Should You Care)?

Net profit is what’s left over after all your expenses are subtracted from revenue. If revenue is your gross income, net profit is what you actually keep.

Simple net profit formula:

Net Profit = Revenue – Cost of Goods Sold – Operating Costs – Marketing Expenses – Fees – Refunds

It’s the number that reflects whether your store is surviving, thriving, or slowly leaking money while your sales chart keeps climbing upward.

Why It’s a Problem in WooCommerce (By Default)

WooCommerce is a fantastic platform. But let’s not pretend it gives you much in the way of financial insights. Revenue? Yes. Order counts? Sure. But:

- No built-in cost of goods input

- No native expenses dashboard

- No ad spend tracking

- No clear net profit reporting (at all)

You’re left cobbling together spreadsheets, pulling data from different marketing channels, guessing at shipping costs per order, and hoping you “probably made money” this month.

This is exactly why we built Alpha Insights—to close this gap and make real profit tracking not just possible, but painless within WooCommerce. But more on that in a bit.

How to Calculate Net Profit in WooCommerce (Step-by-Step)

Step 1: Start With Total Revenue

WooCommerce reports this figure in your dashboard—usually as “Gross Sales” or “Net Sales” (after refunds). You want to start with the amount you’ve actually collected from customers.

Don’t forget:

- Subtract refunded orders

- Exclude canceled transactions

- Include discounts—your profit starts with what came into your account, not just what your product was “worth”

Step 2: Subtract Cost of Goods Sold (COGS)

COGS includes the direct costs associated with producing or purchasing the item you sold. This might include:

- Wholesale product price

- Packaging costs

- Production materials

- Manufacturing labor costs

Many WooCommerce stores skip this step or use outdated product costs. That’s a problem because even small errors in COGS tracking multiply across hundreds (or thousands) of orders.

Pro tip: Use a tool like Alpha Insights to assign and manage dynamic COGS per product and update them as supplier costs change.

Step 3: Deduct Advertising and Marketing Expenses

This is where things often go sideways, because most store owners separate their ad data and forget to link spend to profit.

Include:

- Facebook/Meta ad spend

- Google Ads

- Email marketing tool subscriptions

- Affiliate program commissions

And most importantly, tie those expenses back to the orders they influenced.

Need help connecting ad spend to sales?

Alpha Insights integrates directly with Google Ads and Meta Ads, automatically tracking ad spend against WooCommerce orders so you can view ROI and profitability on a campaign level.

Step 4: Subtract Payment Processing Fees

Platforms like Stripe, PayPal, and Square all take a cut. Maybe it’s 2.9% + 30¢—but scale that across enough orders and it becomes a serious drain.

Be sure to factor in:

- Percentage-based transaction fees

- Fixed processing fees per sale

- Currency conversion or international fees

- Chargeback penalties if you’ve had any

A good net profit calculation subtracts payments fees per order, not just as a monthly lump sum.

Step 5: Deduct Shipping & Fulfillment Costs

Shipping is a sneaky expense. Just because a customer paid $5 for shipping doesn’t mean that’s what it cost you.

Account for:

- Postage and carrier fees

- Packaging and dunnage materials

- Third-party logistics (3PL) fees

- Flat-rate losses (if your flat fee undercharged the customer)

You might also include the labor cost for someone preparing parcels if you fulfill in-house.

Tracking per-order shipping costs is a headache—but Alpha Insights makes it easy. Configure your shipping cost rules once and get accurate shipping expense tracking across every sale.

Step 6: Factor in Refunds and Returns

This one’s painful but necessary. You don’t get to keep the profit on refunded orders, and in many cases, you eat payment fees and lose shipping costs too.

Make sure you’re deducting:

- Refunded revenue

- Restocked COGS (or not, if the item can’t be resold)

- Lost shipping and transaction fees

Automatically adjusting profit reports for returns? Yep, Alpha Insights does that out-of-the-box. No manual recalculations required.

Step 7: Add Fixed Operating Costs

These are the subscriptions, salaries, and run-the-business expenses. They’re not tied directly to orders, but they absolutely impact your profit.

Examples include:

- Web hosting and domain fees

- WooCommerce plugins

- Software subscriptions (email, CRM, accounting)

- Employee or contractor salaries

- Office or warehouse rent

You can use a monthly average, or allocate a percentage of overhead per order to make your reporting more granular.

With Alpha Insights, you can add these fixed expenses as ongoing costs and even distribute them across your order volume for more accurate net profit per order.

Step 8: Look at the Final Equation

Here’s what everything looks like, all together now:

Net Profit = Revenue (after discounts and refunds)

– COGS

– Advertising & Marketing Expenses

– Payment Processing Fees

– Shipping & Fulfillment Costs

– Fixed Operating Costs

Now you have your true picture—the real number that tells you whether your store is scaling sustainable profits or just inflating sales for vanity.

Why Accurate Net Profit Calculation Is a Game-Changer

If you get this one number right, practically everything else gets easier:

- You’ll know which products are truly profitable

- You’ll stop wasting money on campaigns that just look effective

- You can plan discounts and promos strategically—without hurting margins

- You’ll gain the power to scale confidently without overspending

Now imagine having that clarity every day—updated with every order.

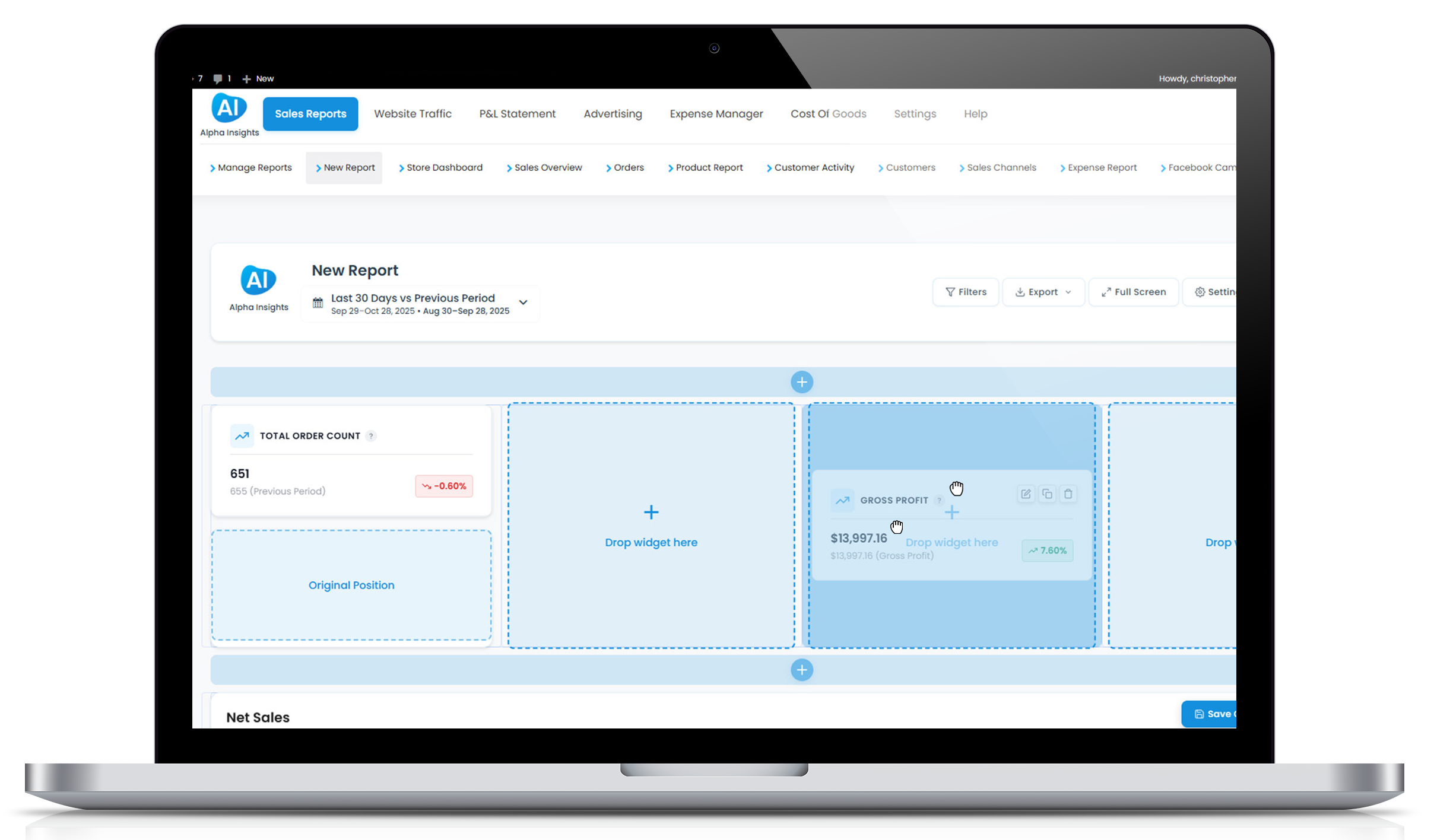

How Alpha Insights Makes Net Profit Tracking Effortless

Let’s be honest. Doing everything we’ve just listed above manually—every week or month—is a solid part-time job. That’s where Alpha Insights comes in.

This is WooCommerce profit tracking, automated and visualized. Real-time reports that show you:

- Profit per product, category, channel, or customer

- Order-level and store-wide net profit reporting

- Ad campaign ROI with Google and Meta integrations

- Transparent breakdowns of every cost and fee

- Refund handling, custom expense rules, fixed costs and more

No spreadsheets. No guesswork. Just profit intelligence built directly into your WooCommerce dashboard.

If you want to scale your store without scaling your spreadsheet habit, give Alpha Insights a try.

Final Thoughts: Know Your Numbers, Grow Your Business

Topline revenue turns heads. But net profit is what keeps stores alive and scaling smarter. It’s the one metric that grounds your decisions in what’s truly working.

Learning how to calculate net profit for your WooCommerce store is a must-do. Automating it? That’s a game-changer.

Want to simplify your net profit tracking and finally know your true margins with one click? Let Alpha Insights do the hard work so you can do more of what you love (and less math).

Your bottom line will thank you.