How to Identify Financial Fragility in Your WooCommerce Store

Running a WooCommerce store can feel a bit like being a sailor navigating through unpredictable seas. One minute it’s smooth sailing with brisk sales and happy customers, and the next minute, you’re caught in the stormy waters of financial instability. But worry not! Just as a seasoned sailor uses the stars to navigate, you can use various indicators to spot and steer clear of financial fragility in your WooCommerce venture.

Let’s embark on this voyage together, where we’ll decode the signs of financial distress and ensure your store not only survives but thrives in the competitive waters of e-commerce.

Understanding Financial Fragility

First off, what do we mean by “financial fragility”? It’s not just about witnessing a temporary dip in sales; it’s about recognizing a pattern that might lead to long-term financial difficulties. Signs of such fragility can include dwindling cash flows, a high rate of returns and refunds, customer churn, or an increased reliance on debt.

To navigate these choppy waters, you need to be well-equipped with the right tools and knowledge.

1. Analyze Your Cash Flow

Cash flow is the lifeblood of any business. A healthy cash flow means your store maintains enough liquidity to cover operating expenses and invest in growth opportunities. To keep a watchful eye on cash flow:

- Monitor Cash Inflows and Outflows: Regularly review your financial statements to assess whether you are maintaining a positive cash flow. Are you collecting receivables faster than you are paying your vendors?

- Examine Cash Conversion Cycle: Calculate how quickly you turn your inventory into cash. A lengthy conversion cycle might be a sign of inefficiencies or stocking issues.

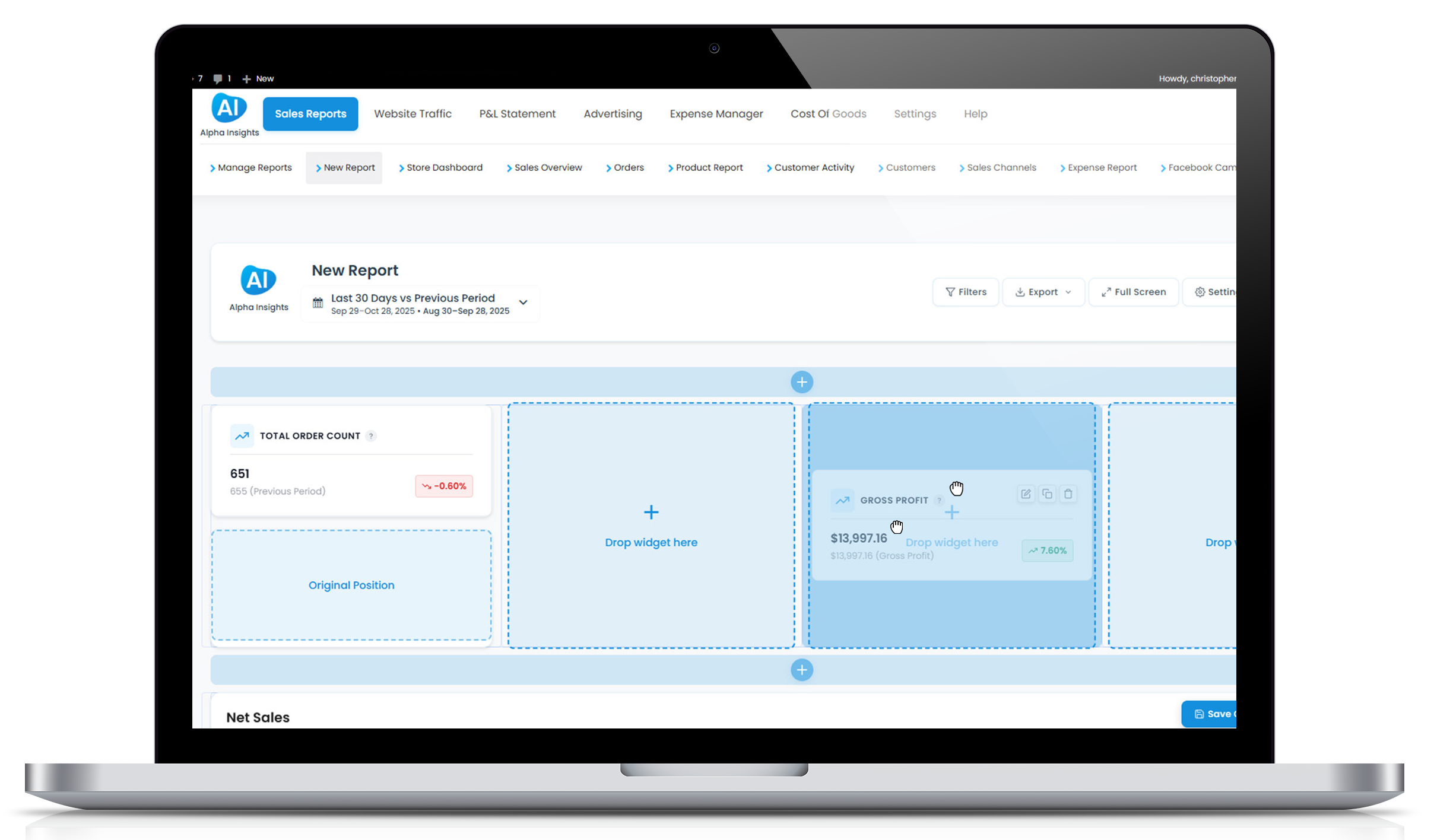

Alpha Insights can be a crucial ally here, offering detailed reports on metrics like average order value and sales frequency that directly affect cash flow.

2. Keep an Eye on Customer Retention

Customers are more than just transactions; they are relationships that need nurturing. A high customer churn rate could be a precursory signal of deeper issues:

- Analyze Customer Lifetime Value (CLV): Determining the CLV helps you understand how different customer segments contribute to your financial stability.

- Review Customer Feedback and Return Rates: High return rates or negative feedback can be early indicators of customer dissatisfaction, impacting repeat sales.

3. Assess Your Debt Levels

While leverage can help grow your business, excessive debt is a common stumbling block for WooCommerce stores, leading directly into the zone of financial fragility. Check your leverage ratios and compare them with industry standards to ensure you’re not overextended.

4. Monitor Profit Margins

Your profit margin is your financial cushion. Keep an eagle eye on it! A declining trend could indicate pricing issues, increased costs, or both:

- Analyze Pricing Strategies: Are your pricing models adapting to market conditions and covering costs? Are there opportunities to improve margins with discounts or premium services?

- Control Costs: Regularly review your expenses, particularly fixed costs, that can eat into your margins if left unchecked.

Leverage tools like Alpha Insights to dive deeper into your profit metrics and understand where adjustments might be necessary.

Implementing Strategic Measures to Fortify Financial Health

Identifying financial fragility is only the first step; taking action to reinforce your WooCommerce store’s health is what ultimately charts the course to success. Here are some strategic measures:

Develop a Responsive Plan

Create a flexible business plan that allows for quick adaptations based on financial health indicators. This plan should encompass strategies for cost management, improved customer acquisition, retention, and potentially diversification of your product lines.

Enhance Operational Efficiency

Improving operational efficiency can significantly reduce costs and improve customer satisfaction. Automate where possible, streamline your inventory management, and optimize shipping and handling processes to save both time and money.

Strengthen Customer Relationships

Focusing on customer experience goes a long way in ensuring repeat business and reducing churn. Implement loyalty programs, request feedback, and utilize personalization to enhance engagement.

Regularly Review and Adapt

Schedule regular financial reviews and use analytical tools like Alpha Insights to gauge your store’s performance against KPIs. These insights will help you anticipate financial issues before they become crises and adapt strategies accordingly.

Conclusion

Just like the ocean, the world of e-commerce is beautiful but filled with hazards. Identifying signs of financial fragility early in your WooCommerce store can mean the difference between smooth sailing and losing course. Use precise tools, stay informed with analytics, and keep your operations lean and mean. With careful planning and proactive management, your WooCommerce store will navigate through rough seas toward the prosperous lands of business success.

Remember, tools like Alpha Insights aren’t just accessories; they are essential navigational instruments that help you track, measure, and optimize your store’s financial health efficiently. All aboard?