The Financial Metrics WooCommerce Stores Should Track Before Scaling

Scaling a WooCommerce store is the business equivalent of saying, “Okay, Google Maps, let’s crank this road trip up a notch!” But before you hit the gas pedal, do you have a clear map of where you’re heading and how your vehicle’s doing? The financial health of your store, dear friend, is that crucial dashboard. Buckle up as we explore the key financial metrics that every WooCommerce store should monitor closely before considering scaling – because, let’s face it, we want growth, not surprises!

Why Track Financial Metrics?

Tracking financial metrics is akin to knowing the rules of the game—a game where stakes are high and the rewards even higher. By keeping an eye on these numbers, you’re doing more than just monitoring; you’re strategizing. It’s about making informed decisions that drive growth without driving your store into the ground. Now, let’s get down to the business of which metrics you should be eyeing like a hawk.

1. Sales Metrics: Your Growth’s Pulse

Sales numbers are the flashy headlines of your business newspaper. They scream success but let’s dive deeper than the headlines:

- Sales Growth: Simply put, how fast your sales are growing. Regularly compare your current sales to a previous period to gauge any growth or decline.

- Average Order Value (AOV): This tells you how much, on average, each customer is spending per transaction. Increasing AOV can be a lever for growth as effective as increasing the customer base.

- Customer Lifetime Value (CLV): Ever wondered how much a single customer is worth over time? That’s your CLV. Higher CLV suggests good customer retention – a gold mine for scaling.

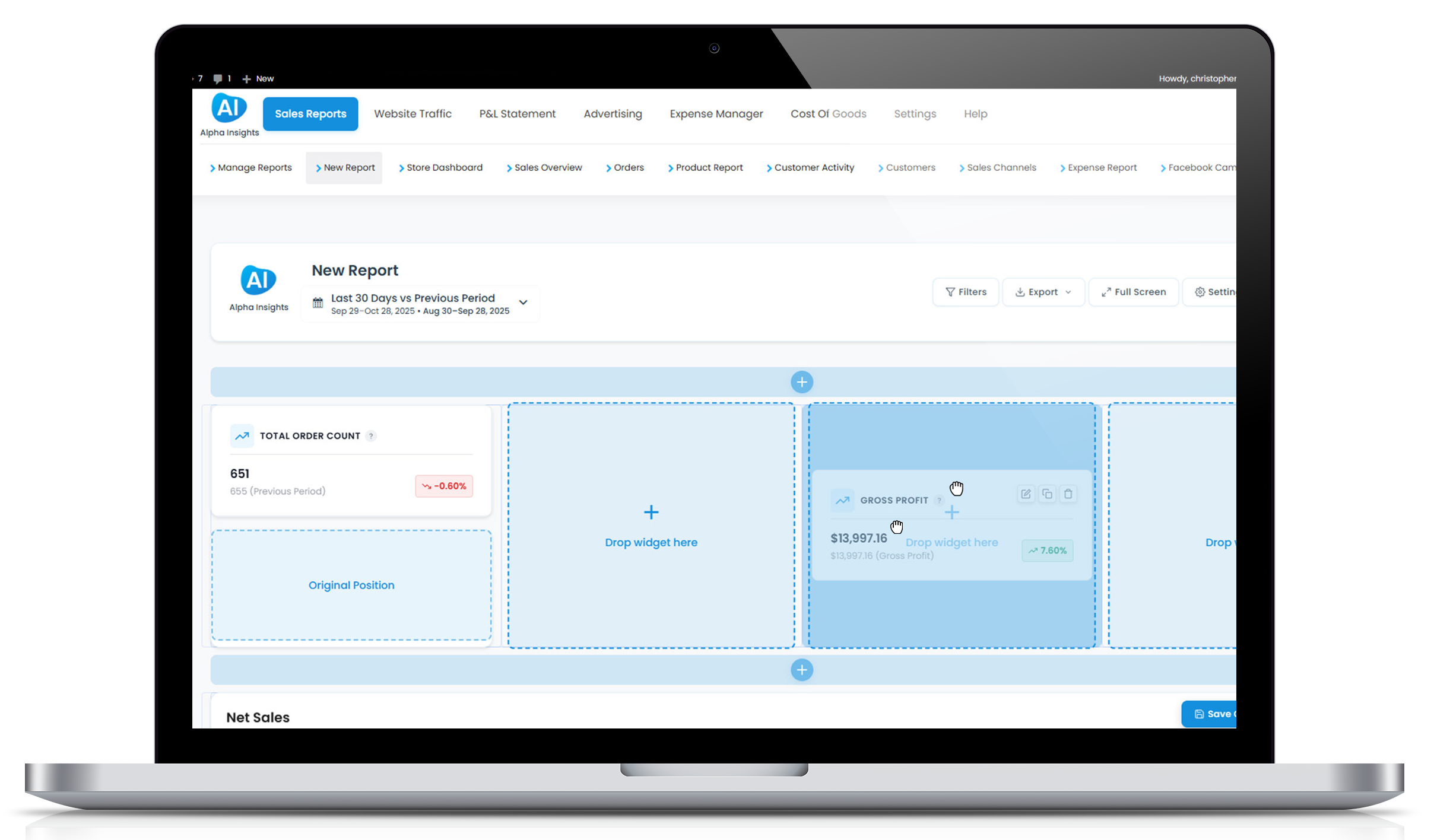

And if numbers make you dizzy, worry not! Tools like Alpha Insights can do the heavy lifting, offering deep dives into these metrics straight from your dashboard.

2. Profit Margins: Not Just Revenue, Real Income

Revenue is dazzling, but it’s profit that fills the piggy bank. Here’s a look at the profit metrics that require your attention:

- Gross Profit Margin: Revenue after deducting the cost of goods sold (COGS). It shows how efficiently you are using labor and supplies in producing your goods.

- Net Profit Margin: This is what remains after all expenses are subtracted from your revenue. It’s the ultimate litmus test of your business’s financial health.

3. Cash Flow: The Lifeline of Your Business

Even profitable businesses can flounder if cash flow is ignored. It’s about when the money enters and exits your accounts:

- Operating Cash Flow: Understand the cash generated from your primary business operations—it tells you if your core business models work.

- Free Cash Flow: This is the cash you have left over after covering capital expenditures. It’s what you can use to pay dividends, reduce debt, and, yes, scale your business.

For a clear picture of your cash flow status, consider connecting with Alpha Insights. It’s like having a financial analyst who’s always on duty.

4. Inventory Metrics: Avoid Surplus or Shortage Pitfalls

Inventory can make or break the scalability of your operations:

- Inventory Turnover: A high turnover rate might indicate good sales or inadequate inventory, while a low rate could mean poor sales or an excess of stock. Balance is key.

- Stockouts and Overstock: Both can be costly. Stockouts lose sales and customer loyalty, while overstock ties up capital and space.

5. Customer Acquisition Cost (CAC): The Price of Growing Your Base

Before you dream of an ever-expanding customer base, understand at what cost you’re acquiring new customers:

A delicate balance between spending to attract customers and the revenue they generate is what CAC is all about. Lowering your CAC while maintaining or increasing the quality of acquisition is a scale-up essential.

6. Return on Investment (ROI): The Efficiency Gauge

Finally, we arrive at the decider: ROI. It measures the efficiency of an investment relative to its cost. Simply, it tells you whether those ads you’ve been running or the new eCommerce tools you’ve integrated are actually worth it. Positive ROI? Thumbs up! Negative ROI? Time to rethink!

Wrapping Up: The Preparation Before the Boom

Knowledge, they say, is power. And in the realm of eCommerce, financial knowledge is not just power; it’s profit, survival, and success. As you consider scaling your WooCommerce store, give these metrics the attention they deserve. Dive into your financial data with tools like Alpha Insights that simplify complexity and amplify your understanding.

With the right numbers on your dashboard, you’re no longer just driving; you’re cruising confidently towards growth. Now, isn’t that a trip worth taking?