Why WooCommerce Stores With “Good Sales” Still Run Out of Cash

So, your WooCommerce store is buzzing! You’re making sales, the numbers keep climbing, and the digital cash register hasn’t stopped ka-chinging since you opened your virtual doors this morning. But here’s the kicker: despite all the sales fireworks, your bank account doesn’t mirror this euphoria. It’s like throwing a party where everyone’s dancing but the DJ’s not getting paid. Confusing, right?

Welcome to the curious case of the disappearing cash scenario. Yes, it’s a thing—and it’s more common than you might think. Today, we’re diving deep into why WooCommerce stores with “good sales” can still feel the financial squeeze, struggling to keep that cash flow positive.

Order up a coffee (or your favorite energy booster), and let’s unravel this mystery together. And while we’re at it, let’s see how Alpha Insights can turn those frowns upside down by shining a light on crucial data that could save your store and your sanity.

Understanding the Cash Flow Conundrum

First off, let’s get our definitions straight. When we talk about ‘cash flow’, we’re not just talking about profits or revenue. Cash flow refers to the net amount of cash being transferred into and out of your business. If you’re selling like hot cakes but your cash outflows are a high-speed train, you’ve got yourself a problem.

Where Does All the Money Go?

It’s not magic, although it often feels like it. Here’s where those seemingly invisible expenses might be hiding:

- Inventory Costs: Keeping stock isn’t free. There’s a fine line between too much and not enough, a balance that can often tip into costly.

- Overhead Expenses: Rent, utilities, software subscriptions, hosting fees, and more. They might seem small on their own, but together, they can eat a big chunk of your revenue.

- Marketing and Advertising: No customers, no sales. But attracting customers costs money—sometimes, a lot of it.

- Sudden Growth: A sudden increase in orders sounds great until the logistics and costs multiply too rapidly for straightforward management.

- Seasonal Fluctuations: High sales in one part of the year can lead to a false sense of security, masking cash flow issues that arise during quieter months.

All these factors, while integral to running your business, can create significant strain on your cash reserves. And if not managed correctly, can lead to a cash crunch despite “good sales”. But fret not! Identifying the problem is the first step towards fixing it.

Diagnosis: Deciphering Data with Alpha Insights

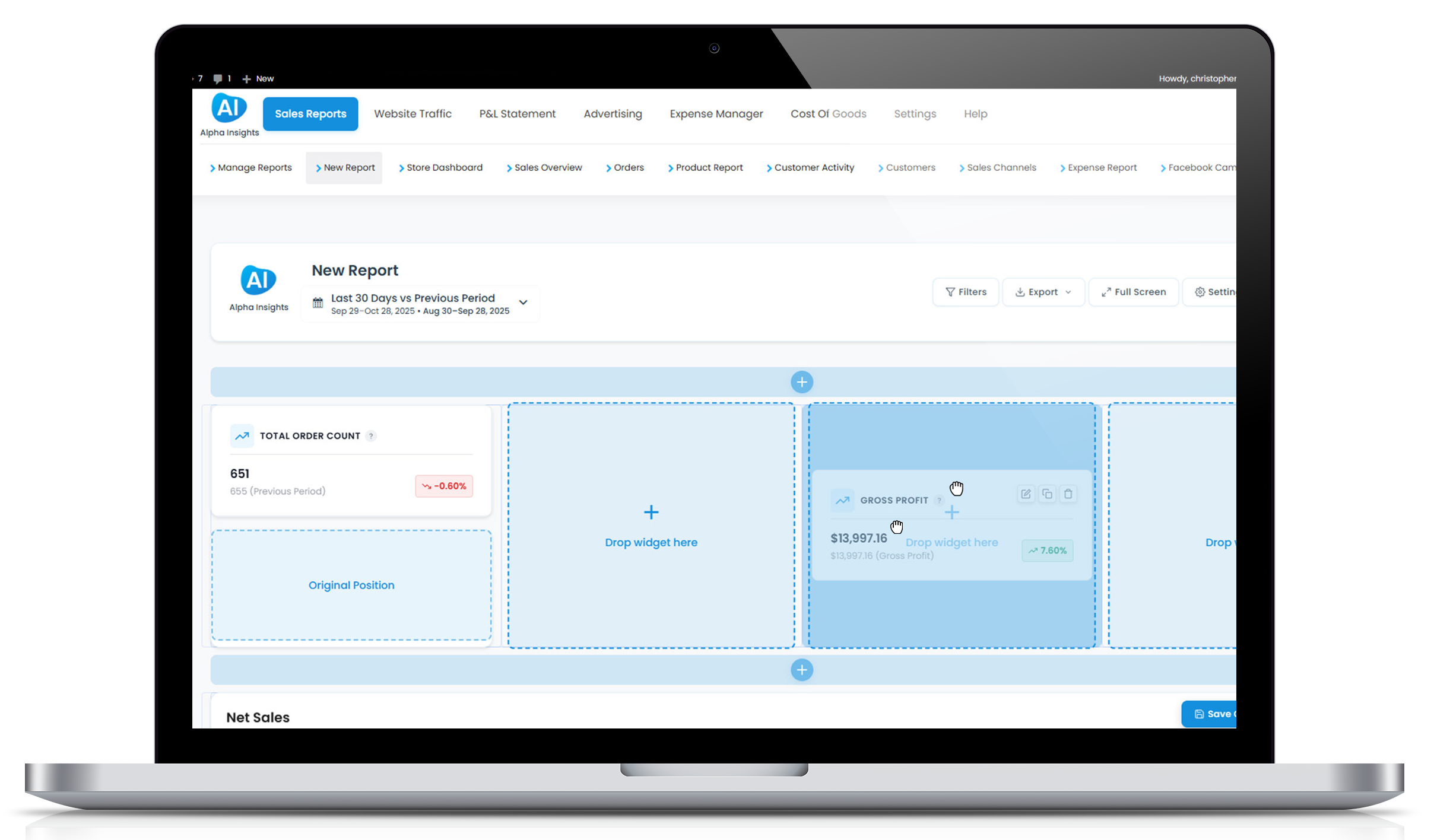

Now that we know why WooCommerce stores might bleed cash despite booming sales, let’s talk cure. How do you keep the dollars from slipping through your fingers? Enter Alpha Insights, your next best friend for financial health.

Real-Time Financial Health Checks

With Alpha Insights plugged into your WooCommerce ecosystem, you’re not just seeing sales data; you’re getting a comprehensive view of your financial landscape. Think of it as having an MRI that zooms into every aspect of your business’s finances, detecting anomalies and trends that you can act on fast.

- Inventory Oversight: Know exactly what products are turning a profit and which ones are just shelf warmers.

- Cash Flow Forecasts: Projection features in Alpha Insights can help you see potential cash flow issues before they become emergencies.

- Cost Analysis: Break down what’s costing you the most and find out if those expenses are genuinely translating into revenue or just burning a hole in your pocket.

This proactive approach to financial management helps you make smarter decisions, not just around inventory and marketing spends, but across all sectors of your business.

Strategies to Keep Your WooCommerce Cash Flowing

Better data leads to better decisions. Here are some tips and how Alpha Insights can help implement them:

1. Optimize Your Inventory

Stock what sells, ditch, or discount what doesn’t. Data-driven inventory decisions minimize holding costs and reduce the risk of overstocking.

2. Budget for Marketing Wisely

With detailed insights into which marketing strategies yield the best ROI, allocate your budget in a way that maximizes your conversions and, importantly, your cash flow.

3. Plan for Seasonal Shifts

Use historical sales data to prepare for peaks and troughs throughout the year. This could mean better deals with suppliers or temporary adjustments to your marketing strategy.

4. Regularly Review Financial Projections

Make it a monthly ritual. Analyze the projections from Alpha Insights to stay prepared and pivot quickly when necessary.

Turning The Tables on Cash Flow Challenges

Running a WooCommerce store with “good sales” that’s still short on cash can be disheartening. But with the right tools and strategies, you can diagnose issues early, make informed decisions, and keep your store financially healthy. It’s all about staying ahead of the game and ensuring that your hard-earned sales turn into tangible profits.

Ready to turn those tricky cash flow puzzles into a clear financial roadmap? Check out Alpha Insights. It’s more than just numbers; it’s about crafting a story of success backed by strong, actionable data.

Turn good sales into great cash flows, and let your WooCommerce store not just survive, but thrive!