Why Your Gross Margin Looks Fine but Net Profit Doesn’t

It’s a tale as old as time—well, at least as old as commerce itself. You pull up your financials, and your gross margin looks healthy enough to compete in the business Olympics. But as your eyes scroll down to your net profit, the numbers seem to wear thin, leaving you puzzled and a tad frustrated. If this scenario feels familiar, grab a cup of your favorite brew; you’re not alone in this conundrum.

Why does this happen? Here, we’ll unravel the mystery of why your gross margin can be deceptively perky while your net profit sits there like a deflated balloon. And of course, we’ll also explore how tools like Alpha Insights can help sharpen your financial insights.

Understanding Gross Margin vs. Net Profit

Before we dive into the quirks of financial statements, let’s set the stage with some definitions for clarity:

- Gross Margin: This is the difference between sales and the cost of goods sold (COGS), expressed as a percentage of sales. It’s like the first chapter in the story of profitability, telling us how efficiently we are producing or sourcing the products we sell.

- Net Profit: This is the grand finale in our profitability story. Net profit is what remains from sales after all expenses are subtracted. If gross margin is about operational efficiency, net profit is the reality check that includes rent, utilities, salaries, marketing costs, and sometimes, those unexpected expenses.

Understanding the distinction and the relation between these two metrics is crucial for diagnosing financial health in a business.

The Discrepancy between Gross Margin and Net Profit

So why might your gross margin suggest a parade-worthy performance while your net profit mirrors a rainy day? Let’s delve into some of the most common culprits:

Operational Expenses Eating into Profits

Operating expenses are often the silent snipers targeting your net profits. These can include:

- Employee salaries and benefits

- Office supplies and utilities

- Rent or mortgage payments on business property

- Marketing and advertising costs

- Depreciation of assets

- And more…

Even if your gross margin looks great, high operating costs can quickly gnaw away at your bottom line, leaving less than expected for net profit.

Inefficiencies and Wastage

Another factor to consider is operational efficiency. Here’s a scenario: your gross margin is stellar because you’re buying raw materials in bulk at a discount. But if half of those materials spoil or become obsolete, your net profit will inevitably suffer. This aspect can be particularly tricky to pin down without the right analytics tools, like Alpha Insights, which help highlight inefficiencies that could be leading to wastage or unplanned expenses.

Taxation and External Factors

Another key player in this dynamic is taxation. Depending on your jurisdiction, different taxes (income, sales, property) can significantly impact your net profits. Furthermore, external factors such as economic downturns, regulatory changes, or increased competition can pressurize both your margins and profits.

Using Data to Bridge the Gap

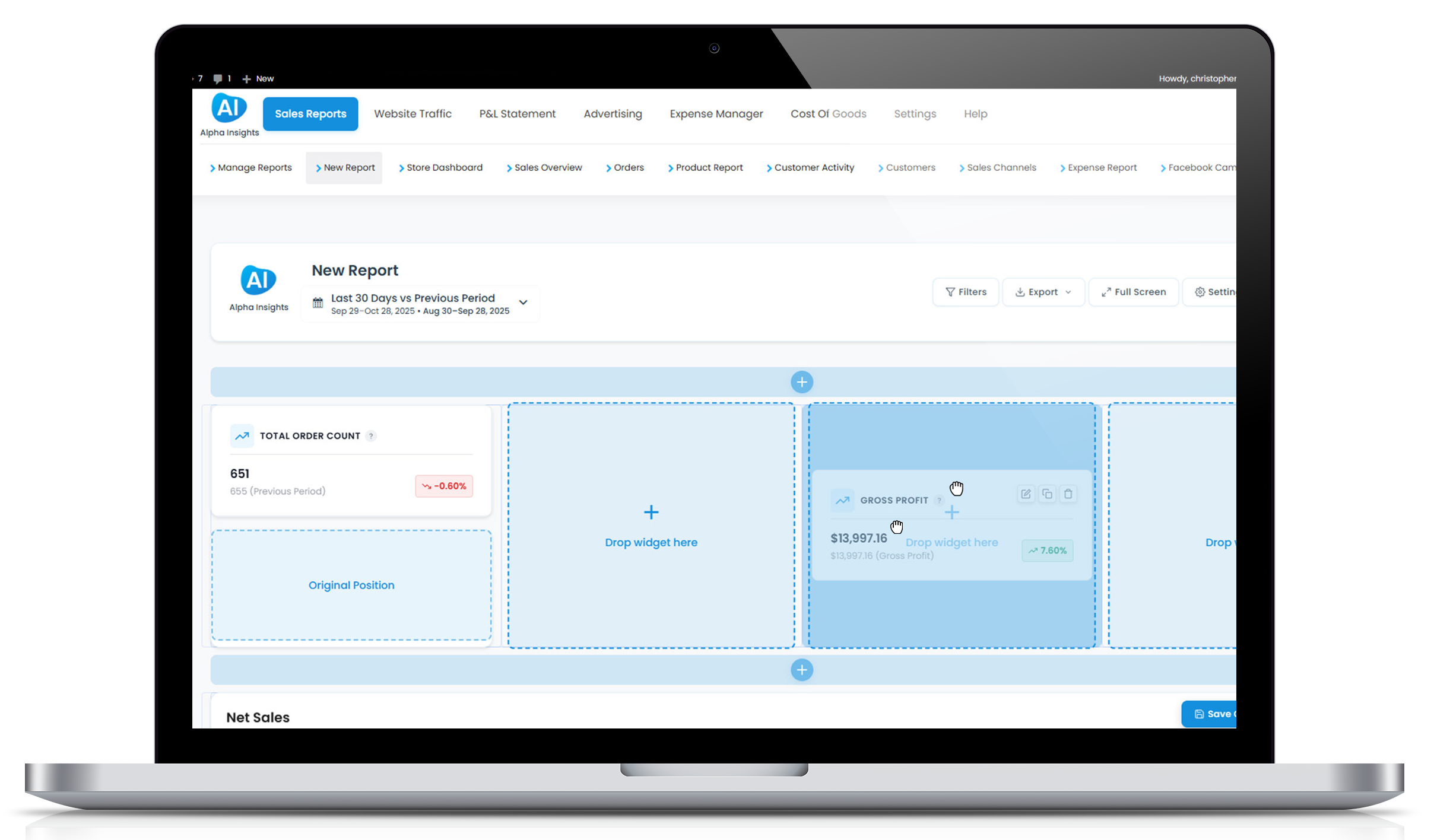

Identifying why your net profit doesn’t match up with your gross margin often requires a deep dive into your business analytics. This is where powerful tools like Alpha Insights step in. Wondering how it enhances your financial clear-sightedness? Here’s how:

- Detailed Expense Reports: Understand where your money’s going with granular breakdowns.

- Profitability Analysis: See not just what you’re earning, but what you’re truly keeping.

- Inventory Management: Get insights into inventory turnover and product performance to cut down on wastage.

Gaining a comprehensive view of these elements can help you take control of both your operational costs and profit margins, aligning them more closely for overall financial success.

Best Practices to Improve Your Net Profits

While right tools give you the insight, the right practices provide the solution. Here are some actionable tips to transform your net profit narrative:

- Trim the Fat: Regularly review your operational expenses to identify any areas where you can cut costs without impacting product quality or customer satisfaction.

- Increase Operational Efficiency: Look into process improvements and technologies that can reduce waste and enhance productivity.

- Optimize Marketing Spend: Use ROI-focused marketing strategies to ensure you’re not just throwing money into the wind.

- Regularly Consult Analytics: Keep a pulse on your financial and operational metrics by regularly consulting an analytics tool like Alpha Insights.

Understanding the dynamics of gross margin versus net profit is fundamental in sculpting a robust bottom line. It’s about having both a macro and micro-view of your business finances, and wisely navigating your resources to bolster not just sales, but profits.

So, if you’re ready to not just make money but keep it too, why not let a specialized tool light the way to better profitability? Dive into your financials with clarity and confidence with Alpha Insights today!