How to Predict Cash Flow for Your WooCommerce Store

Running a WooCommerce store is exciting. Sales roll in, products ship out, and every now and then, you get a little dopamine hit from your Stripe or PayPal notifications. But between today’s sales and next month’s bills, there’s a critical metric that most store owners shove to the bottom of their to-do list: cash flow.

Here’s the deal—you can have a growing, busy, and even “profitable” WooCommerce store on paper, and still run into serious cash problems. The culprit? Poor cash flow forecasting. And unlike your next viral product idea, predicting your cash flow isn’t something you can afford to guess at.

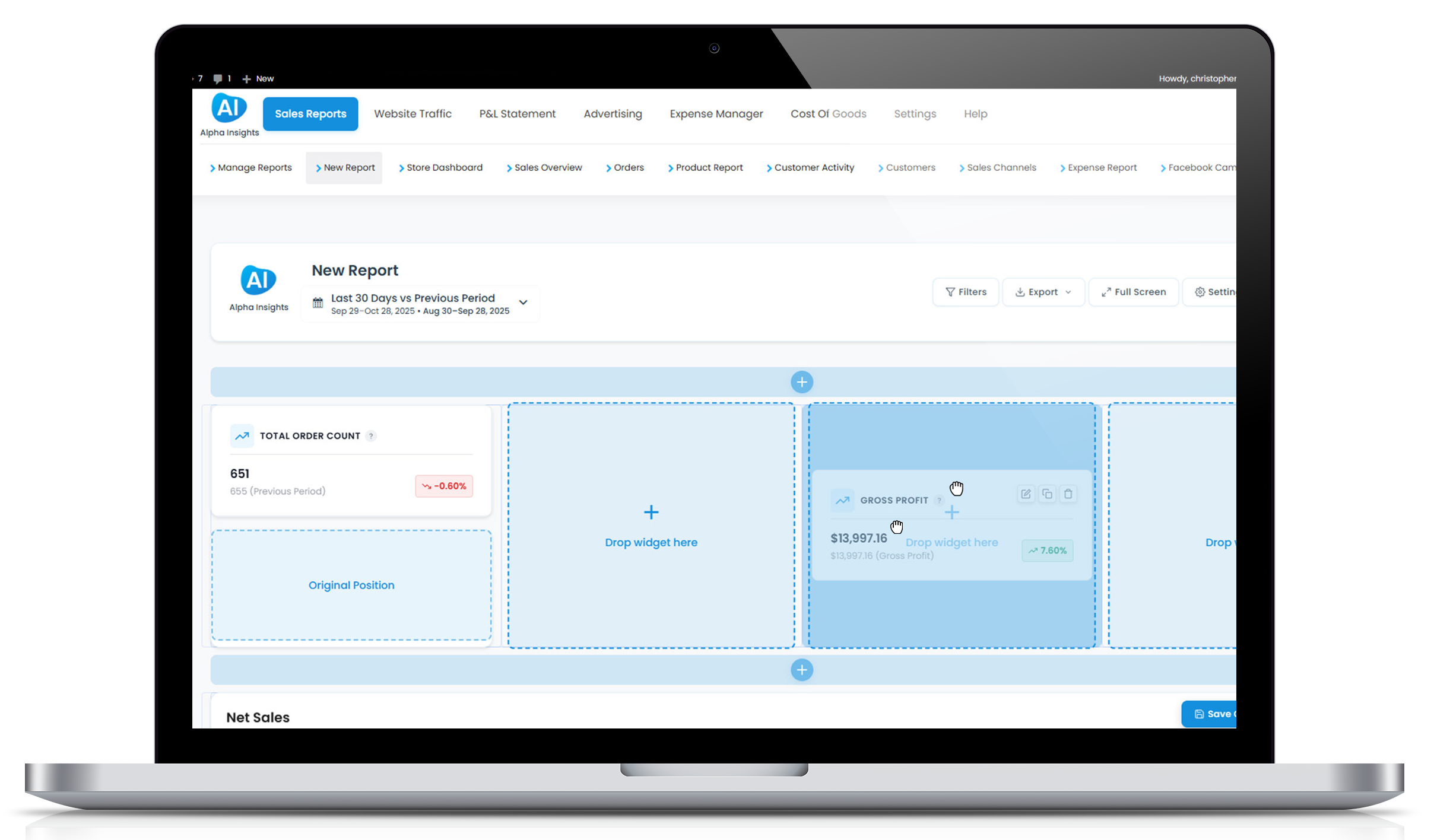

In this guide, we’ll walk you through the basics (and then some) of how to predict, plan, and make better decisions with cash flow forecasting for your WooCommerce store. Plus, we’ll show you how Alpha Insights can bring clarity to the chaos by tying your store’s financial performance to actual profitability—on a product level.

What Is Cash Flow (And Why Should You Care)?

Cash flow is simply a measure of how much cash is moving into and out of your business at any given time. It answers the question: Will you have enough cash on hand to cover your expenses next week? Next month? Next quarter?

For WooCommerce store owners, cash flow is especially tricky. Inventory purchases, ad spend, and fulfillment costs often need to be paid long before you realize the revenue from those orders. Get it wrong, and you might owe suppliers when your bank account is looking suspiciously empty.

Cash flow forecasting allows you to:

- Know when to reinvest in inventory or wait it out

- Avoid panic when big expenses like hosting renewals or tax bills hit

- Plan promotions around actual financial runway

- Sleep better at night (seriously)

The Difference Between Profit and Cash Flow

A lot of store owners confuse cash flow with profit. And while they’re related, they are far from the same thing.

Here’s the difference:

- Profit: What remains after you subtract all your expenses from your revenue. It’s what you see on a Profit & Loss (P&L) report.

- Cash flow: The actual timing of money entering and exiting your business bank account.

So yes, your store might clear $20K in profit last month—but if you just dropped $11K on a new batch of inventory, $3K on Facebook ads, and your next shipping bill hits tomorrow… you could be in trouble.

Why Predicting Cash Flow Feels Hard (But Doesn’t Have to Be)

Let’s be honest. Forecasting cash flow feels like a chore. It involves estimates, planning, and sometimes a messy spreadsheet or two. And when life (and business) moves fast, it’s tempting to just check your daily sales, thumb through your bank transactions, and hope for the best.

The problem with this tactic? Hope isn’t a very scalable strategy.

Fortunately, the process of forecasting your WooCommerce store’s cash flow isn’t as painful—or as complex—as you’d think. And it starts by knowing exactly what’s coming in, what’s going out, and when those cash movements actually occur.

Step-by-Step: How to Predict Cash Flow for Your WooCommerce Store

Step 1: Understand Your Revenue Timing

Your sales numbers might look great in WooCommerce, but when does that actually turn into spendable cash?

Map out:

- Payment processor delays (Stripe, PayPal, etc. can delay transfers by 2–7 days)

- Refunds or chargebacks that reduce collections

- Subscription revenue that’s collected monthly or annually

Start by analyzing your average daily or weekly revenue, but make sure to align it with when the cash actually hits your account.

Pro Tip:

Using Alpha Insights, you can track real-time revenue at the product level—including returns—so your revenue forecasts aren’t inflated by phantom sales that come back as refunds.

Step 2: List All Fixed and Variable Expenses

Next, identify all cash outflows. This includes recurring expenses (fixed) and expenses that scale with your business (variable).

Fixed costs include:

- Website hosting and software subscriptions

- SaaS tools (like email platforms, inventory software, etc.)

- Employee or contractor payroll, if applicable

Variable costs include:

- Cost of Goods Sold (COGS)

- Shipping and fulfillment expenses

- Advertising spend (Facebook, Google, influencers, etc.)

- Transaction fees (payment processors, gateways)

And remember—some expenses won’t occur evenly across the month. Recurring tools might bill annually or mid-month. Huge ad costs can hit just after a campaign ends. Capture these timing differences in your forecast.

Step 3: Calculate Your Net Cash Flow

The formula is simple:

- Net Cash Flow = Cash In – Cash Out

Each week (or even daily), subtract your expected expenses from your expected cash collections. This will tell you whether you’re building a cash surplus (yay!) or heading for a cash deficit (time to pivot).

This step is where most DIY forecasts break down. They rely on “gut feeling” or round-number guestimates. But with Alpha Insights tracking your actual expenses, advertising ROI, and order fulfilment costs, you can forecast with a much higher degree of accuracy—and sleep easier at night.

Step 4: Stress-Test Your Worst-Case Scenarios

Now that you’ve got a base forecast, let’s shake things up a bit. Ask yourself:

- What if sales dip by 25% next month?

- What if your ad costs spike without warning?

- What if your biggest supplier requires up-front payment earlier than expected?

These “what-if” scenarios give you a range of predictions and help you plan for bumps, not panic when they happen.

How to Use Past Data to Predict Future Cash Flow

You’ve heard the cliché: “Past behavior is the best predictor of future behavior.” Fortunately, this holds (mostly) true for cash flow too.

Here’s what historical data can show you:

- Sales seasonality or dips (e.g., post-holiday slowdowns)

- Increased ad spend before major launches

- Inventory cycles and reordering length

- Times when you were tight on cash (and why)

With a tool like Alpha Insights, you can identify trends across months or quarters, including which products and channels delivered cash-positive results—and which ones… didn’t.

Bonus: 5 Cash Flow Forecasting Mistakes to Avoid

1. Forecasting Revenue Based on Your Best Month Ever

We get it. That October sale was 🔥, but don’t assume that’s the new normal. Stay conservative.

2. Ignoring Refunds and Returns

If you’re not factoring in product returns or transaction disputes, your future cash might be…fictional.

3. Forgetting One-Time Expenses

New laptop? Trade show booth? Paid theme upgrade? Unexpected or annual costs can knock your projections sideways if you’re not planning ahead.

4. Treating Ad Spend Like Free Money

Spending $1K on Instagram ads and making $1.5K in sales? Great! But if your margin was 20%, you lost money—and potentially killed your cash flow. Analyze ROI, not just revenue. Alpha Insights makes this process seamless.

5. Not Updating Your Forecast Weekly

This isn’t a “set it and forget it” spreadsheet. Revisit your forecast every week and adjust based on new data, campaigns, or expenses coming in.

Improve Your Cash Flow Forecasting with Alpha Insights

If staring at spreadsheets or copying numbers out of WooCommerce gives you a headache, there’s good news. Alpha Insights was built specifically for WooCommerce store owners who want a clearer picture of what’s driving profit—and what’s draining cash.

With Alpha Insights, you can:

- View real-time profitability per product and per channel

- Track ad spend and digital marketing ROI, right inside WooCommerce

- Analyze historical financial performance and trends

- Make spending decisions based on actual, accurate data

Instead of blindly scaling ads, adding SKUs, or reordering inventory, you’ll make smarter, cash-flow-friendly moves that lead to sustainable business growth.

Final Thoughts: Predicting Cash Flow Is an Advantage, Not a Luxury

You don’t need an accounting degree or a Big Four auditor on speed dial to get a handle on your cash flow. What you need is visibility—and a willingness to plan a few steps ahead.

The best WooCommerce stores don’t just scale faster. They spend better, forecast smarter, and build longer-lasting businesses by managing cash flow proactively—not reactively.

And with tools like Alpha Insights, getting the financial clarity you need has never been easier.

Cash flow prediction may not sound glamorous. But it’s the not-so-secret weapon behind every wildly successful eCommerce store.

Start tracking. Start planning. Start sleeping better.